14 de July de 2021

IFC

AMAGGI receives USD 209.5 million financing to expand cotton cultivation in Mato Grosso

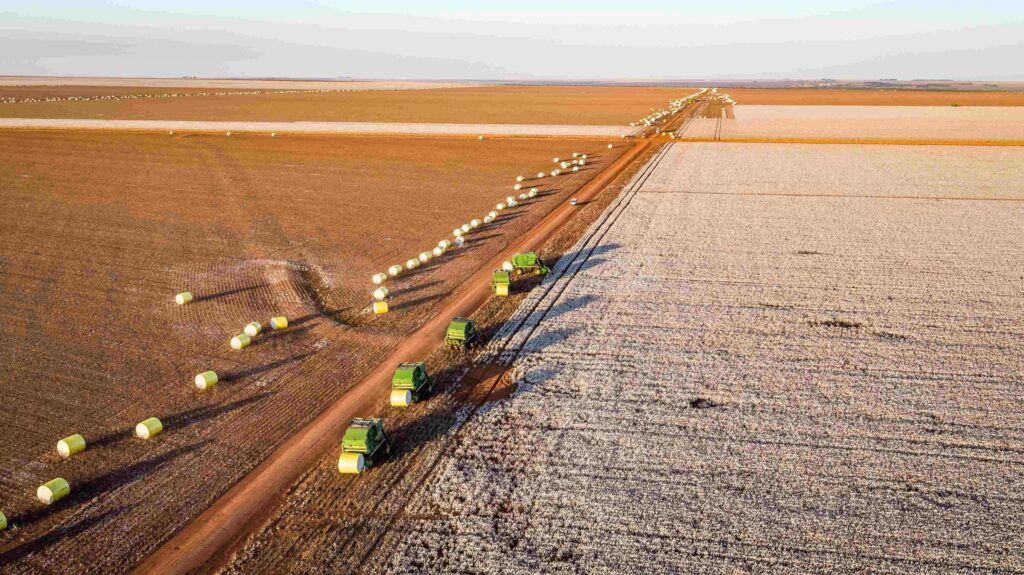

Sustainable and 100% traceable, AMAGGI’s Agropecuária Maggi cotton production is expected to expand to at least 4 of the company’s farms in the state of Mato Grosso over the next 3 years, thanks to a USD 209.5 million financing received from IFC (International Finance Corporation) and the banks Rabobank and Santander. The terms were signed on May 17.

“In recent years, cotton has become increasingly relevant at AMAGGI, which has invested heavily in sustainable management, socio-environmental certifications and 100% production traceability. Financing from such judicious institutions – such as IFC, Rabobank and Santander – confirms that we are on the right path to meet international market demands “, assesses AMAGGI’s CEO, Judiney Carvalho.

Of the USD 209.5 million to be invested in AMAGGI over 3 years, USD 100 million will be earmarked directly by IFC, a member of the World Bank Group and the largest global development institution focused on the private sector in developing countries. IFC invests in companies through loans, equity investments, debt securities and guarantees, among others. The investments also cover another USD 39.5 million to be allocated by the Managed Co-Lending Portfolio Program (MCPP), managed by IFC, and the remaining USD 70 million will be invested, in equal shares, by Rabobank and Banco Santander S.A.

All cotton production linked to this international fundraising is zero deforestation and meets socio-environmental criteria such as the Better Cotton Initiative (BCI) and the Responsible Brazilian Cotton Seal (ABR), also in line with the company’s Socio-Environmental Policy and the Global Sustainability Positioning. In addition, the AMAGGI Cotton Traceability and Sustainability (ACTS) program ensures that the company’s entire cotton production is traceable from its origin through to its final destination.

“One of IFC’s strategies in Brazil is to reconcile the country’s economic growth and sustainability challenges. Thus, IFC’s investment will help support AMAGGI’s growth while also demonstrating sustainable cotton production feasibility. We are certain that this will encourage other cotton producers to adopt better production practices, strengthening the sector’s competitiveness and supporting the cotton sustainability agenda around the world”, assesses IFC’s manager in Brazil, Carlos Leiria Pinto.

Mato Grosso Projects

The financing granted by the institutions is linked to projects to expand and improve the cotton culture on the farms: Tanguro (in Querência), Itamarati (in Campo Novo do Parecis), Água Quente and Tucunaré (both in Sapezal). Initiatives linked to investments by IFC and the Managed Co-Lending Portfolio Program (MCPP) have a maximum maturity of 9 years; the projects linked the Rabobank and Banco Santander S.A investments have a maturity period of 7 years.

The projects unfold onto 4 fronts: conversion of areas destined for the cultivation of corn into cotton plantations; construction of cotton processing units; investments in logistical assets and agricultural inputs so to support the expansion of cotton growing on these farms; investments in protection and treatment inputs to improve productivity of existing cotton crops.